- The Exit

- Posts

- Is Your Dream of Funding Turning into a Nightmare? 14 Scams Targeting First-Time Founders

Is Your Dream of Funding Turning into a Nightmare? 14 Scams Targeting First-Time Founders

Raising funds for the first time? Hold. Up. 🛑 You NEED to read this before you get burned.

Raising funds for the first time? Hold. Up. 🛑 You NEED to read this before you get burned.

Two weeks ago, I tweeted about funding scams. Yeah, the dark side of startup dreams.

And wow, did it explode. Founders and investors came out of the woodwork with stories…

One email in particular hit hard:

VC Email

Look, nobody wants to think about scams when you’re chasing your startup vision. But trust me, they’re out there. And first-time founders? You’re basically wearing a “fresh meat” sign sometimes (sorry, but it’s true!).

In this post, I’m ripping the curtain back on 14 ways founders like YOU get scammed when raising funds. No sugar-coating, no holding back. Just the raw truth to protect your baby (your startup!).

No name-and-shame here (except maybe for the practices themselves 😉). It’s all about arming you with knowledge so you can dodge these bullets.

Ready to dive into the startup scam jungle? Let’s go, from the “meh, annoying” to the “OMG, run for your life” scams.

Got another scam story? Spill the tea! Email me at [email protected] — totally private and confidential.

Table of Contents

Scam #3 — The pay-to-pitch (👈 We’re looking at YOU, Pay-to-Pitch!)

Scam #1 — The bait-and-switch

Okay, this one’s not evil, but it’s a major time-waster. Imagine this:

You get a LinkedIn message: “Hey founder! Love what you’re building, let’s chat about investment!” 🤯 Exciting, right?

You hop on a call, ready to pitch your heart out. But BAM! Five minutes in, they’re pitching YOU their fundraising services. 🤦♀️

Yep, they’re not investors. They’re fundraising advisors using the old bait-and-switch to get leads. Sneaky and super annoying when you’re busy building a company.

Bottom line: If they switch to selling you something on an “investor call,” peace out. ✌️

(NB: Legit fundraising advisors exist, and some are investors too. The scam is the bait-and-switch tactic to drum up business when they never intended to invest).

Scam #2 — The pay-to-play

This one’s where things start getting shady and costing you actual cash.

Investor call starts off great. They seem interested! Then comes the curveball: “Before we move forward, there are some… fees.” 🚩🚩🚩

“Due diligence fees,” “Appraisal fees,” “Processing fees” — it’s all BS for “give us money for a chance.” You pay upfront, they might consider you, and if nothing happens? Too bad, so sad, you’re out of pocket.

Seriously, imagine a contract like this actually existing:

Pay 2 Play

Crazy, right? It’s a business model where you fund their business… by paying for the privilege of maybe getting funded. Nope.

Rule #1 of Fundraising Club: YOU DON’T PAY THE INVESTOR’S BILLS. Exception? Maybe covering some legal/DD costs at closing when the money is basically wired. But upfront “fees”? RUN. 🏃♀️🏃

Scam #3 — The pay-to-pitch

Okay, this one REALLY grinds my gears, especially because I almost fell for it myself early on. It’s a close cousin of “pay-to-play.”

They want you to PAY to pitch your startup to investors. Let that sink in.

Think about it: If you’re a hot startup, investors should be fighting to hear you, not the other way around. If you’re not quite there yet, paying to pitch won’t magically make you investable.

And get this — even investors sometimes get tricked into judging these paid pitch fests! A real investor told me:

Pay To Pitch

“They asked me to judge startup pitches. Startups PAY to pitch (WTF). They told startups I’m actively investing in their area and judging, blah blah. Seen this SO many times from founders who got suckered in. Stopped doing this stuff years ago.”

Yep, it’s a thing. And frankly, it preys on founder desperation.

Personal Story Time (and a Startup Grind Shout-Out… but not in a good way):

Early in my founder journey, I was invited to a Startup Grind pitch competition. Sounded cool, right? “Pitch to top investors!” “Get amazing feedback!”

Then came the price tag: $3,000 for a ticket. 🤯 Three. Thousand. Dollars. To maybe pitch for a few minutes.

I was naive back then, but even my gut screamed “SCAM!” Luckily, I dodged that bullet. But seriously, $3,000 to pitch? For a first-time founder? That’s insane.

Look, Startup Grind might have some legit events, but this “pay-to-pitch” model? Hard pass from me. There are way better ways to spend $3,000 on your startup. Like, I don’t know, actually building your product? 😂

Moral of the story: If someone wants you to pay to pitch to investors, it’s a massive red flag. Run the other way. Your pitch is valuable. You shouldn’t have to pay for someone to listen.

(NB: Some investors do offer paid advisory calls or pitch deck reviews. That’s different. They’re selling their time/expertise, and they’re usually upfront about it. “Pay-to-pitch” is about paying for access to investors, which is the scam).

Find your ACTUAL ideal investors for FREE 🚀

Forget pay-to-pitch. Browse 5,000+ real investors, share your pitch deck, and manage replies — all for zero dollars. Seriously.

Scam #4 The VC on payroll

This one’s sneaky and looks kinda legit on the surface.

“Investor” Johnny Angel says he’s in for $40k! Awesome! 🎉 But wait… there’s a “small” condition. You need to hire Johnny as an “advisor” for $2k a month. Hmm…

Let’s do the math: In 20 months, Johnny gets his $40k investment back in “advisor fees”… AND he still owns equity in your company! 🤯 Genius for Johnny, terrible for you.

Real investors advise you because it’s in their best interest for you to succeed! It’s part of the deal. A few hours of advice a quarter doesn’t equal a monthly salary.

Real talk: If you need a serious advisor with a big commitment, have a separate conversation and structure proper compensation (equity, milestones, etc.). But don’t let an “investor” strong-arm you into paying them back their investment through a fake “advisor” role.

Money Disappears

Scam #5 — The “heads I win, tails you lose”

Investors are supposed to share the risk, right? WRONG. Sometimes they try to shift all the risk onto you with crazy terms.

I saw a term sheet from China that made my jaw drop. If the startup failed, the founder was personally liable to repay the investor. 😳

Dude, that’s not venture capital. That’s a loan with extra steps… and extra pain for you.

Hard pass. Venture is about shared risk and shared reward. If they’re not sharing the downside, walk away.

Coin Flip

Scam #6 — The “we know him”

LinkedIn is a goldmine for scammers, apparently. This one’s about fake connections.

A fundraising advisor or broker-dealer slides into your DMs: “Hey, we’re super connected, we know everyone in VC! Especially REDACTED.”

They drop names, act like they’re best buds with top VCs. They might even say, “Oh yeah, we were just talking to REDACTED about startups like yours!” Sounds impressive, right?

“Happens all the time! 3 times this week! People add me on LinkedIn, then tell startups, ‘Oh, we know REDACTED really well! They’ve done [X, Y, Z]!’ I’ve even seen emails where they claim to know me so well, I’m like, ‘Wait, do I know them?’

Truth is? I maybe had one quick call with them. But they’re stalking my LinkedIn daily.”

Pro tip: If someone’s “connection” to every investor sounds too good to be true… it is. Do your own digging. Don’t rely on vague “we know people” claims.

I don't believe you

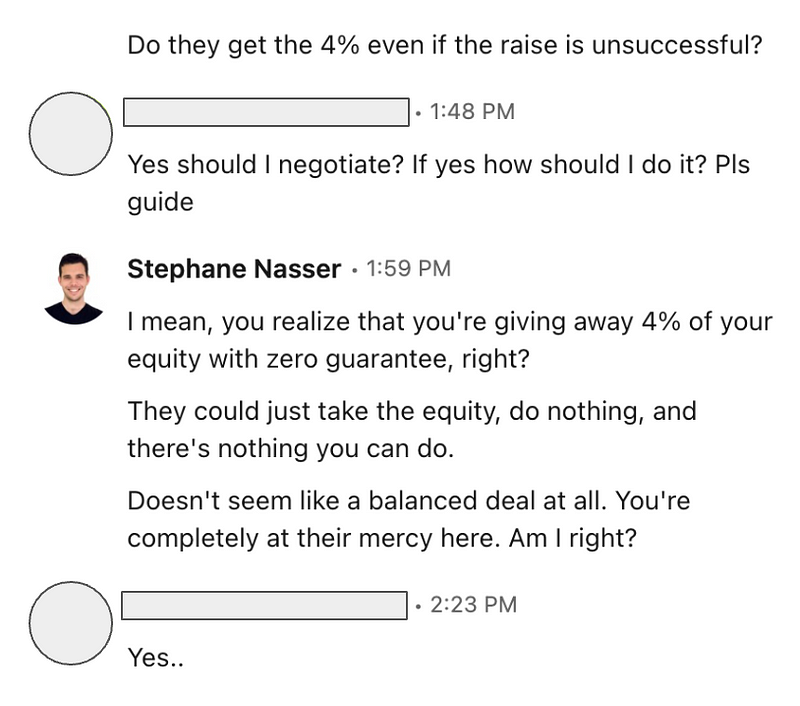

Scam #7 — The “let’s do equity instead”

This one’s a mind trick. They start by quoting you a hefty advisor fee — say, $5,000 a month. Ouch, startup budget can’t handle that.

Then, miraculously, they say, “Hey, we love your project so much, we’ll take equity instead! Just 4% of your company!” 🥳 Sounds like a deal, right? They’re “believing” in you!

WRONG. They’re still trying to get paid, just in a sneakier way. And 4% equity for intros that might go nowhere? That’s highway robbery.

What if their intros are duds? They still walk away with 4% of your company. For… what exactly? Looking good on your “Team” slide?

Don’t trade valuable equity for vague promises of “connections.” Equity is for people building the company with you, not for random advisors who might send a few emails. Hard. Pass.

Lets do equity instead

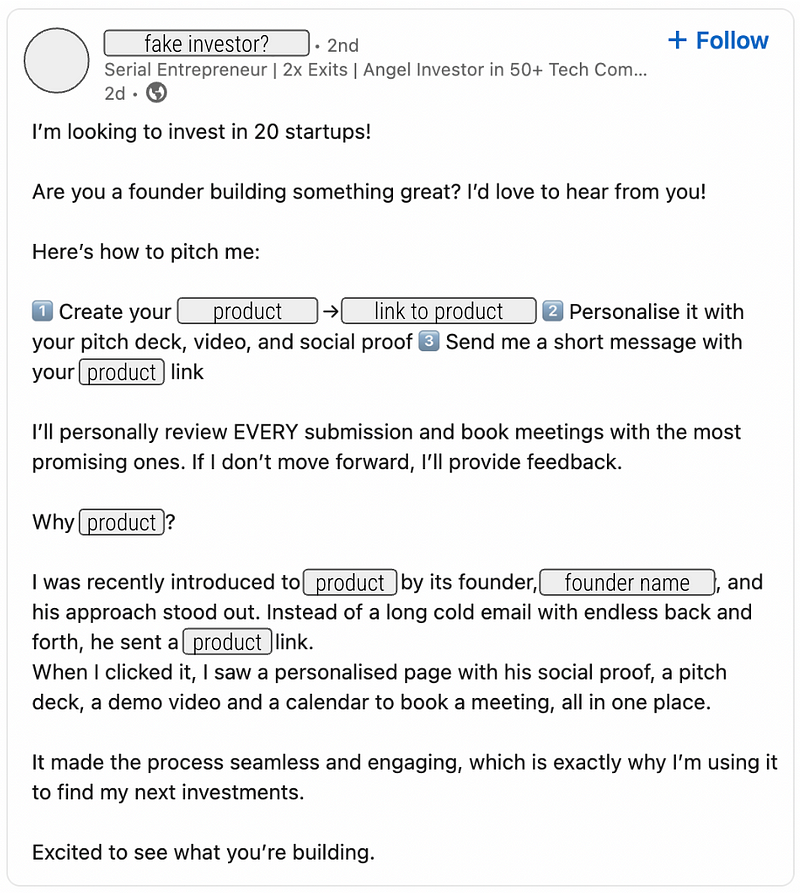

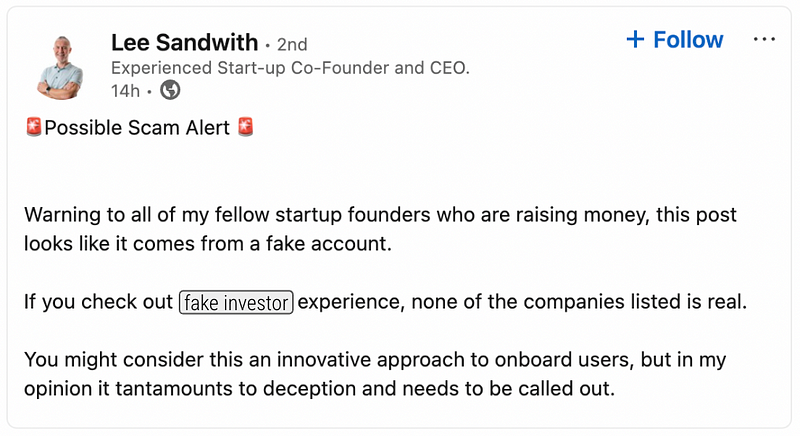

Scam #8 — The “Use this app to apply”

LinkedIn strikes again! Fake investor profiles are a thing.

“InvestorBro69” messages you: “Hey founder! We’re actively investing in ai ! Submit your deck through our amazing new app to get reviewed!” 🚀 Sounds efficient!

You click the link, and it’s some janky app you’ve never heard of. You check “InvestorBro69’s” profile — stock photos, generic “VC” title, no real fund listed. 🚩🚩🚩

It’s a lead gen scam. They’re building an app and using fake investor profiles to trick founders into signing up and giving them data. Your deck and info are just bait for their business.

Use this APP

Don’t fall for the “shiny app” trick. Do your homework on the “investor” before clicking random links and handing over your precious pitch deck.

Scam Alert

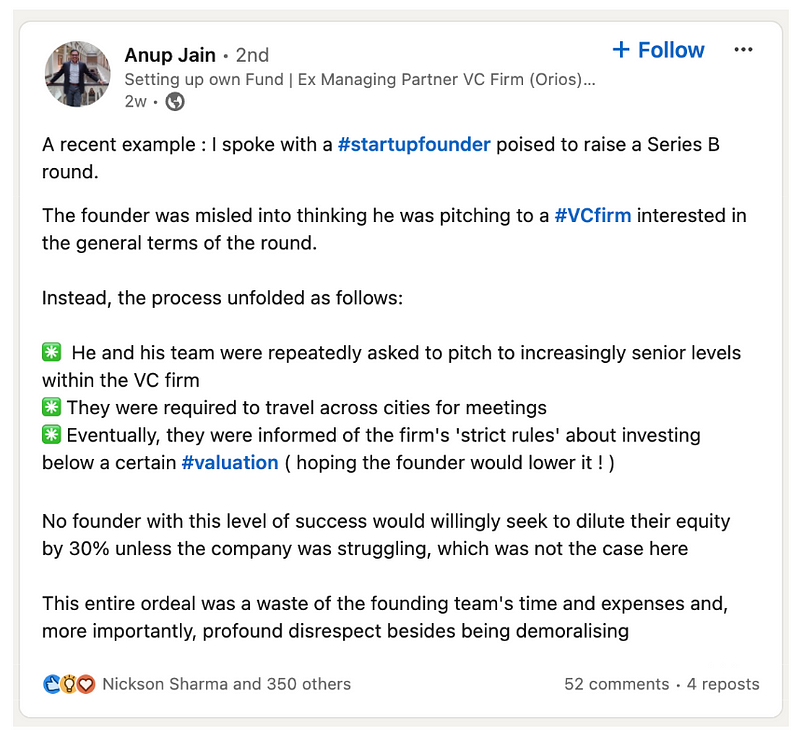

Scam #9 — The drag-and-drop

Okay, now we’re getting into stuff that even real VCs sometimes pull (not cool, VCs, not cool).

The “drag-and-drop” is when an investor strings you along. Lots of meetings, “positive signals,” maybe even a term sheet! You think you’re golden. You stop talking to other investors (mistake!).

Then… BAM! They drop you. “Valuation is too high now.” “Market conditions changed.” “Funding is now in tranches with impossible milestones.” Excuses, excuses.

Your runway is shrinking, you’ve lost momentum chasing this dead-end deal, and now you’re scrambling. Ouch.

The Drag and Drop

Don’t get dragged. Momentum is everything in fundraising. Keep talking to multiple investors until the money is actually in the bank. One term sheet is not a done deal.

You wont take me alive!

Scam #10 — The spearfishing

Another VC dick move. Investor contacts you, seems legit, asks for a pitch and data room access. You happily oblige, thinking you’re building a relationship.

Then… crickets. Silence. Ghosted. 👻

Congrats, you’ve been spearfished! They never intended to invest. They just wanted free market research, competitive intel, or maybe info for their portfolio companies. They used you for data. Jerk move.

It sucks, but thankfully, it’s not super common. Most VCs are (hopefully) more ethical than this. But be aware it can happen.

The spearfishing

Scam #11 — All accelerators?

“Accelerators are scams!” I hear this a lot. And yeah, some are… not great. But it’s not black and white.

Think of accelerators like this:

No cash investment = Service Provider, not Accelerator. If they don’t put money in, they’re basically a paid course or consultancy. Nothing wrong with that, just know what you’re paying for (and watch out for scams #3 and #7!).

Accelerator Deals: Not Always a Rip-Off. $200k for 8% might sound pricey compared to later-stage VC. But accelerators invest early, when VCs and angels are still on the fence. For many first-time founders, that accelerator check is the only funding option. It’s apples and oranges comparison.

Value is in the “Value-Add.” Mentorship, connections, workshops, etc. For experienced founders? Maybe not worth it. For first-timers? Could be gold. It’s not one-size-fits-all.

Bottom line: Some accelerators are awesome, some are meh, some are straight-up bad. Do your research. Talk to alumni. Don’t assume they’re all scams, but don’t assume they’re all magical either. Know what you’re getting into.

Accelerators

Scam #12 — The crazy good deal

“We’ll invest more than you asked for! And at a higher valuation!” 🤯 This VC is amazing! Sign me up!

Whoa there, slow down. “Too good to be true” alarm bells should be ringing LOUD.

Here’s the catch:

Inflated Valuation = Down Round Risk. High valuation now makes the next round harder. If you can’t justify that valuation later, you’re looking at a painful down round.

Sneaky Terms to Protect Them, Not You. They’ll load up the term sheet with clauses like 3x liquidation preferences. Sounds fancy, but it means if things go south, they get paid back 3x their investment before you see a dime. They get more, you get less.

Bad Equity Cliff

Today’s “amazing deal” can become tomorrow’s nightmare exit.

Focus on a fair deal, not just the highest valuation. Long-term health of your company > short-term ego boost.

Scam #13 — The dirty sheets

Term sheets. They look official, but they can hide nasty surprises.

Just last night, an OpenVC founder almost got nailed by a super shady term sheet. Luckily, another OpenVC investor spotted the red flags and flagged it. Community saves the day!

Dirty term sheets

Truth bomb: You can sneak anything into a term sheet if both sides agree. Doesn’t make it fair or standard.

Read. Every. Single. Line. Get a lawyer (see rule #9 ). Don’t sign anything you don’t 100% understand and are comfortable with. Keep those term sheets CLEAN.

Dirty

Scam #14 — The lethal vesting

This one’s niche, but brutal. Real story alert:

VC firm hires a new CEO for a struggling startup in their portfolio. Deal for the CEO: “Get us a $2M round in 12 months, we have investors lined up. Close the round, you get 10% of the company and co-founder title!” Sounds like a challenge, but potentially awesome, right?

New CEO busts their butt, works like crazy. Turns out… VC had zero investors lined up. Red flag #1. But the CEO is a champ and somehow pulls off TWO term sheets from top-tier VCs in 11 months! Hero mode!

Then… the VC pulls this:

This one hits way too close to home. I went through something eerily similar with a startup called CoVoice.

I joined as CTO and took on everything — architecture, backend, infrastructure, debugging, managing contractors, and more. I was promised equity and revenue share under a leadership agreement. The equity? One-year cliff. The revenue share? Vague and conveniently never tracked. The pay? Barely enough to cover rent. But I believed in the mission, so I pushed through.

Then — months in, after doing the heavy lifting to keep the product functional — I got locked out of all systems and fired over Slack after business hours. The reason? “New tax obligations.” No prior notice, no conversation, no offboarding. Just gone. No equity. No share. No acknowledgment.

Turns out it was calculated. I was disposable labor until real costs kicked in.

So yeah, these “high-upside, equity-after-you-prove-yourself” deals? They sound exciting, but when the other party controls the milestones and the exit door, you’re just a cost-effective stopgap. Legal? Probably. Ethical? Not even close.

Watch out for “founder deals” that only pay off once you’ve done 10x the work and crossed some vague finish line. Especially when the people on the other side of the table can move that line any time they want.

Vesting should reflect contribution, not manipulation.

Send help, indeed.

Legal? Yep. Ethical? HELL NO. Lethal for the CEO’s motivation and trust? Absolutely.

Send Help

Vesting should be fair and aligned with contribution. Watch out for deals that sound too good to be true, especially if they rely on unrealistic milestones controlled by the other party.

There are no VC scams, only poorly informed founders

Ouch, harsh title, I know. But there’s truth in it. Fundraising is scammer paradise because:

Endless Supply of Newbies: Thousands of first-time founders pop up every year. Fresh meat!

Beginner Blindness: First-timers often don’t know standard practices, term sheet norms, or even basic scam red flags.

Emotionally Charged: Founders are passionate, driven, and often emotionally invested in their startups. Scammers exploit that vulnerability.

It’s a constant stream of uninformed, excited, and sometimes naive founders ripe for the picking. I’m not exaggerating.

Founder raising funds (2024, colorized)

Look, most founders are figuring it out as they go. You’re used to the “safe spaces” of consumer protection, HR departments, and corporate processes.

But fundraising? Wild West, baby. You’re on your own. No safety net.

Fundraising isn’t rocket science, but you gotta do your homework and use your brain. Don’t be naive. Don’t be prey. Don’t fall for the BS.

My 10 Commandments of Scam-Proof Fundraising (for First-Time Founders Like You):

Thou Shalt Be Skeptical AF. Free lunches don’t exist. If it sounds too good to be true, it’s a scam. Trust your gut.

Thou Shalt Educate Thyself. Fundraising is mostly standardized. Read blogs (like this one 😉), books, ask experienced founders. Knowledge is your shield.

Thou Shalt Tie Compensation to Results (Where Possible). Align incentives with advisors, etc. If they only get paid when you succeed, they’re more likely to actually help you succeed.

Thou Shalt Stalk (Research) Investor Portfolios. See who else they’ve backed. Any competitors? Any red flags in their portfolio? Low-hanging fruit research.

Thou Shalt Do Reference Checks Like Your Life Depends On It. DM 3–4 founders in an investor’s portfolio before signing anything. Ask the tough questions. Real talk from real founders is gold.

Thou Shalt Get It In Writing (Always). Verbal agreements are worth less than toilet paper. Putting it in writing forces clarity and provides legal backup.

Thou Shalt Not Over-Share in Your Pitch Deck. Assume your deck will be leaked. Don’t put super-confidential info in there. Act accordingly.

Thou Shalt Use a Two-Stage Data Room (Like a Pro). Control access to sensitive info.

Thou Shalt Lawyer Up (Early and Often). Startup fundraising lawyer is NOT optional. Yes, it costs money. But it’s insurance against financial disaster. Worth every penny.

Thou Shalt Never Stop Raising (Until the Bank Says “Cha-Ching!”). One term sheet is just the start of the race, not the finish line. Keep options open. Keep leverage. Money in the bank = deal done. Until then, hustle on.

Follow these commandments, and you’ll dramatically increase your chances of raising funds safely and successfully. Now go forth and build amazing things… without getting scammed! 💪